Seniors rush to finish financial aid forms on time

Academic Counselor Martina Torres stands in front of the FAFSA and CADAA board on Jan. 26. Torres adds the name of senior students who have completed their FAFSA or CADAA to mark the overall student progression.

February 17, 2023

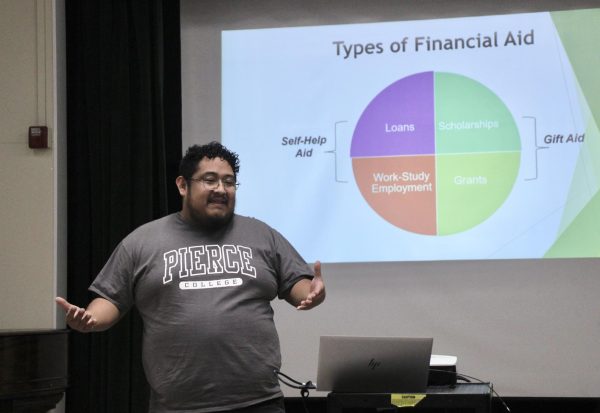

As the Free Application For Federal Student Aid (FAFSA) and California Dream Act (CADAA) application deadlines are approaching on June 30, seniors are rapidly submitting their forms with the guidance of School Counselor Martina Torres.

“It’s (FAFSA and CADAA) the only way that students could be eligible for any financial aid from the start,” Torres said. “That’s one of the ways that students are eligible for financial aid, if approved.”

FAFSA is a form any United States citizen meeting academic standards of a 2.0 GPA (C average) can complete in order to receive financial help for college from the federal government. This is contrary to CADAA, in which a student who applies for the application does not have to be a United States citizen, but instead can be an undocumented student or a student with a visa, according to California Student Aid Commision.

According to FederalStudentAid, if a student wants to add any corrections to their application, they must have it re-submitted by Sept. 9. But if a student fails to apply entirely, they are no longer eligible to submit that year’s FAFSA form.

CADAA doesn’t have a strict deadline but students are encouraged to submit their forms by March 2 to increase their financial aid options according to csac.ca.gov.

“The first step is to create the Federal Student Aid ID,” Torres said. “Then the second step is to gather the tax documents, the 2021 tax documents from parents in order to start the FAFSA application or CADAA application.”

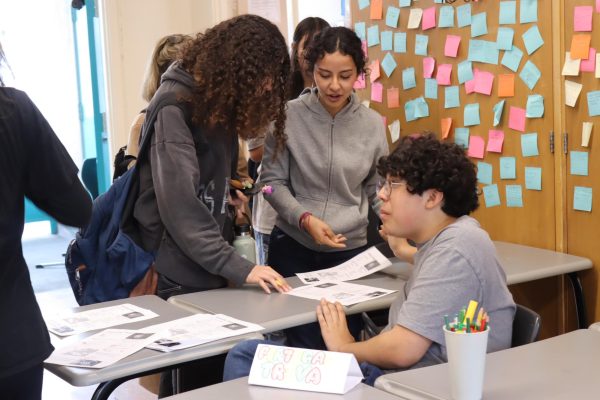

Jasmine Orozco is one of the 24 DPMHS students who has finished their application. For her, the second step of the process was the most complicated. It requires an individual to include their parent’s tax information, as well as information about their household income, according to Education Loan Finance.

“You need your parents’ tax forms and it seems like the most difficult part until you actually start going through it and it’s just like a tedious process,” Orozco said. “Just finding out how to do it was hard because it was confusing when I first found the website. Having someone to help you is always a good idea.”

The complexity of the second step is something senior Lucia Avellaneda can agree on. Avellaneda said it is difficult at first because you need to file your parents’ taxes and getting all the necessary information for that on its own was a struggle.

The easiest step of the FAFSA application process for both Avellaneda and Orozco was step one: creating an account where you input your information such as your social security number, your birthday and your name.

“It’s more time consuming and something we can get confused on but it’s a fairly easy process to go through compared to other things,” Avellaneda said. “I think most people can go through it in less than an hour, which was very helpful for me.”

Whether you are a senior working through the financial aid forms or a junior seeking to prepare for the future, it’s a good idea to learn more about your options such as what is required for the FAFSA and CADAA form and consult with your counselor.

“Seniors must complete their financial aid form,” Torres said. “They can complete FAFSA as one of their two options or they can choose their other option which is the California Dream Act Application. But they need to speak to me to help determine which one they should do if they don’t already know.”