H&R Block simulation frustration

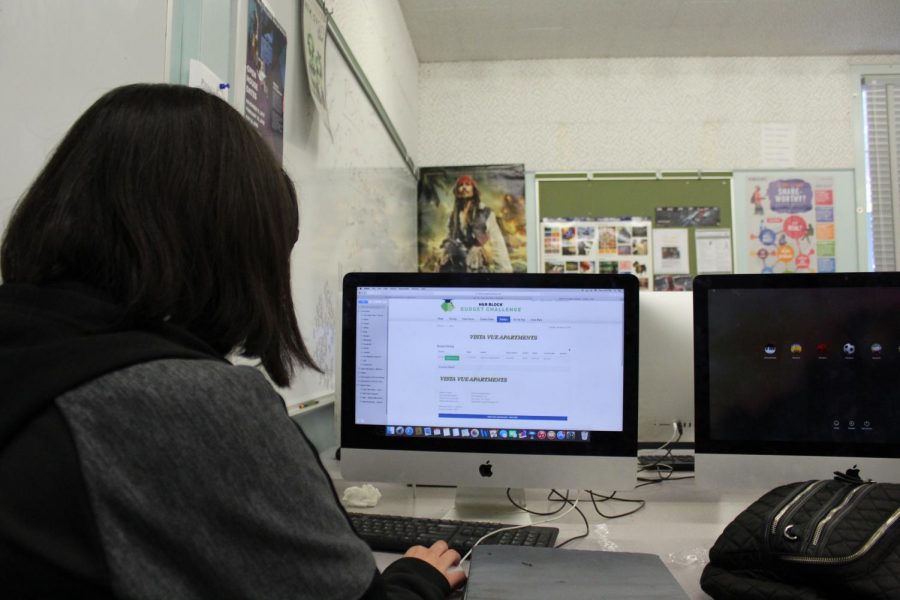

Senior Mabel Aceves logs into account to pay her rent as part of the H&R Block Budget Challenge, a simulation that helps teach students how to spend and budget money wisely.

February 7, 2018

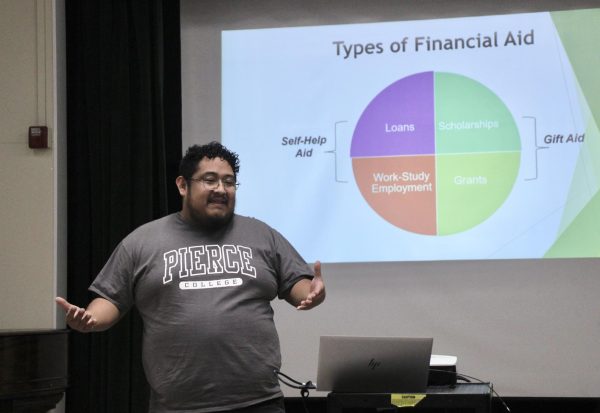

With the help of the H&R Block Budget Challenge, honors economics students are being introduced to different techniques for assistance in money management and financial planning.

“It’s a scenario where students work with a job about how to essentially budget for life,” honors economics teacher Davy Mauermann said.

As an approach to educate high school students with basic financial skills, the H&R Block Budget Challenge is using real life scenarios and simulations to teach students how to budget money more efficiently. The simulation project is only limited to honors economics students, who will be the first class to participate in this new project.

“I think I’ll gain at least at least an idea of what to do in the real world and what options to pick,” senior Francheska Vicents said. “I’ll also get a glimpse of the unexpected obstacles that life can throw at me.”

The three-month long project is designed to give students the tools to have a more financially stable future, teaching them basic skills such as paying bills on time and tracking savings. With these skills, students are given a better idea of what to do with their money and the benefits of budgeting.

“This will teach me skills to balance my money in order to pay for all the bills and all the college spending that I’m going to have to face when I’m an adult in college,” senior Paola Rivas said.

Each student is given a different real life scenario as a recent college graduate with a paying job. With fees and expenses to pay on a regular basis, students receive a virtual salary and are given the freedom to choose how to spend it. These expenses include car payments, utility or phone bills which all must be paid on time.

Just like the real world, if students do not pay bills on time, they will get penalized with virtual fees such as overdraft fees, late fees or finance charges. Students are also challenged throughout the course of the project, as they may run into unplanned fees and must find space in their budget to pay them.

“I think it’s scary because it makes you face adulthood and it also has an impact on our grade,” senior Ruzanna Manvelyan said.

Not only will this project help students with budgeting, H&R Block will offer $200,000 in scholarships and cash prizes. The top five highest-scoring students will each receive a $20,000 college scholarship and the assurance that they are ready for the real world.

“I think it’ll be interesting when we get to see the results because we will be able to see who will make it out into the real world versus who won’t make it and struggle,” Rivas said.