Five tips to help you figure out the 2014 FAFSA

December 6, 2013

Now that the deadlines for college applications are approaching, with some being in November and some in January, there is yet one more thing that high school seniors must worry about.

It is the FAFSA application, or the Free Application For Federal Student Aid. Financing a college education is something that won’t be easy, but getting the most out of college financial aid surely helps, as it can be very expensive.

Even if you’re not a senior yet, learning as much as possible about financial aid will help in the long run.

1. Know your deadlines. The FAFSA document is released every year on January 1. Although different schools have different deadlines for turning in the document, know the deadlines for each school you applied to and write them down so you have them handy. This is the most important thing as you do not want to miss any deadlines.

2. Gather all of the necessary documents. The FAFSA asks for information that you should already know, such as your name, date of birth and address. Although, you will most likely need a number of other documents such as your social security number, your parents’ social security number, your driver’s license (if you have one) and tax information.

This may seem like a lot, so be sure to have your parents with you when filling out the FAFSA, as they will most likely already know all of this information. If your parents are separated or divorced, have the correct parent who is your legal guardian help you.

“I’ve been keeping my parents updated with everything and I’m keeping track of things carefully,” senior Michella Mousaed said.

3. Don’t think you’ll get financial aid? Try anyway! When one first applies for financial aid, it’s tough to estimate just how much you will actually receive. Even if you know your family makes a lot of money, apply anyways.

You will still likely qualify for some sort of financial aid, and just applying should help in the long run. Students who don’t apply for financial aid before going to college will most likely be banned from asking for institutional aid as they progresses in their college education.

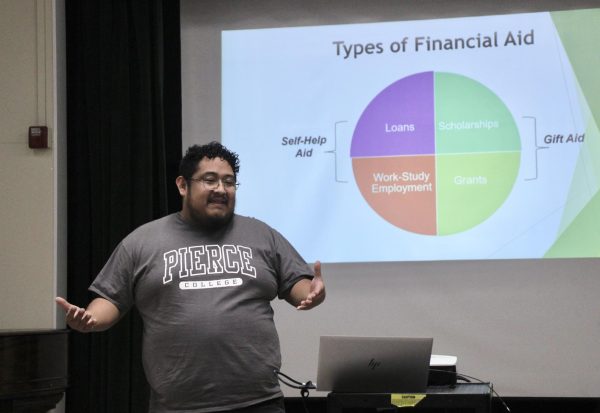

4. Understand the different types of aid. There are grants, loans and scholarships. Make sure to read and research the type of aid that you think would benefit you the most.

5. Check for errors! Small errors can ruin your chances of getting financial aid. Be sure to review all information with a parent/guardian before submitting.