College Corner: Five tips on saving for college loans

March 13, 2014

College graduation is often the time to celebrate accomplishments and look ahead to the future. For many graduates, however, it’s also a time to tally student loans and figure out how to repay them.

The key is to start thinking about loans and paying for college now rather than later. Here are five tips to help you save some money.

1) Start looking for scholarships. Begin searching for scholarship opportunities that you may be eligible for. The required Grade Point Average (GPA) for merit or other scholarships is often 3.0 and above.

The higher your GPA is throughout high school, the higher your chances are for getting scholarships. There are also other scholarships awarded to certain ethnicities or for recognizing community service or racial background.

People with more volunteer hours or who are of a minority race are often more likely to get scholarships.

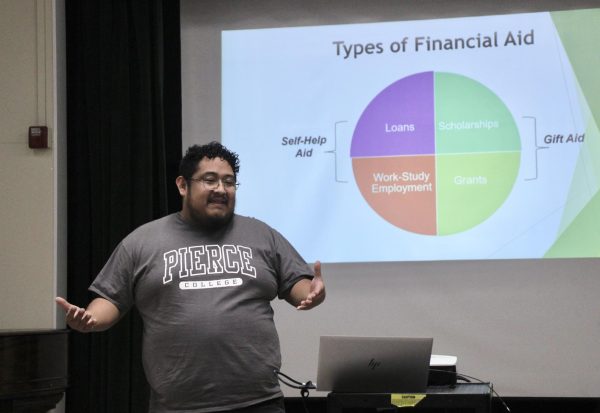

2) Apply for financial aid programs. There are several financial aid opportunities like the Free Application For Federal Student Aid. Be sure to turn in all of the necessary forms on time and even if you think that you may not be eligible, apply anyway. You never know where money can come from

3) Start with community colleges classes. It’s suggested to take college classes during high school since they allow you to earn credit for free, saving you money you would have paid to take the classes in college.

4) Choose your major early. This one may seem a bit odd, but it has some merit. If you don’t know what your major is going in, you may end up paying extra money for classes that you may not have needed to complete your major.

5) Start now. The earlier you start looking, the more opportunities will be available. Make use of every possible opportunity to build a more successful and relatively debt-free future.